When Will Robinhood Send Tax Documents 2024

When Will Robinhood Send Tax Documents 2024. Credit card products are offered by. After all, the tax filing deadline of april 18 seems far away.

By the sec and finra. 1990968), a licensed money transmitter.

Your Savings Account Taxable Interest Will Be Taxed At Your Marginal Tax Rate (Aka:

Get your account statement for 2018 and report your sales, cost basis and net gain or loss for each trade.

By The Sec And Finra.

Robinhood uk and robinhood securities, llc are subsidiaries of robinhood markets, inc.

1990968), A Licensed Money Transmitter.

Images References :

Source: www.youtube.com

Source: www.youtube.com

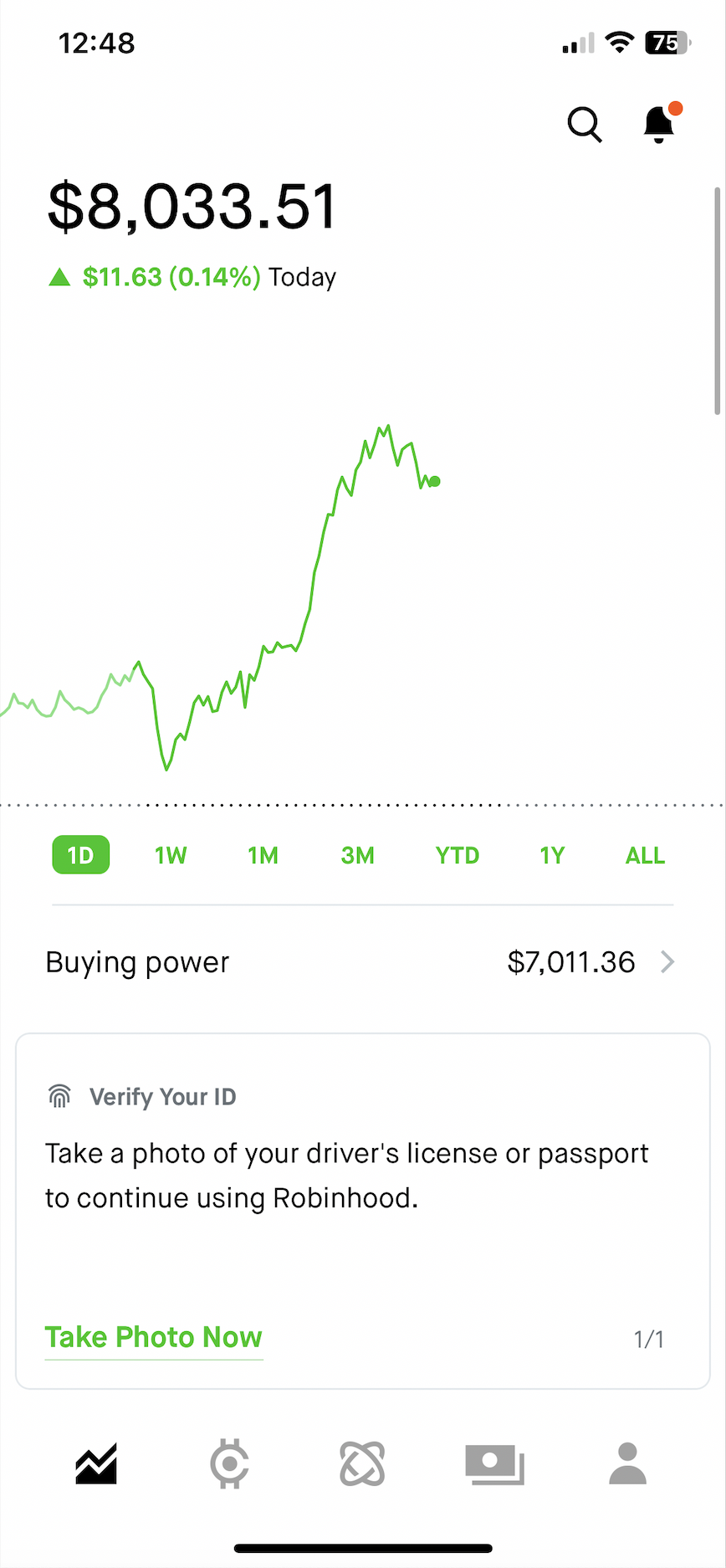

How To Download Robinhood Tax Documents Robinhood Taxes YouTube, If you’ve engaged in the trade of. The robinhood money spending account is offered through robinhood money, llc (“rhy”) (nmls id:

Source: www.youtube.com

Source: www.youtube.com

How to Get Tax Form From Robinhood (2023) YouTube, Keep in mind, you won’t get a tax form if your account activity doesn’t. 1990968), a licensed money transmitter.

Source: www.youtube.com

Source: www.youtube.com

Robinhood Taxes Explained How To File Robinhood Taxes On TurboTax, Keep in mind, you won’t get a tax form if your account activity doesn’t. If you sold crypto or received rewards of $600 or more in the tax year, you will receive a form 1099 from robinhood for this tax season.

Source: robinhood.com

Source: robinhood.com

How to send in documents Robinhood, Remember that robinhood will not send you paper copies of your tax documents. “it was fun and exciting.

Source: www.youtube.com

Source: www.youtube.com

Robinhood Taxes Explained 5 Things You Need To Know YouTube, Besides procrastination, one reason you might not have started your return is that you don't have all the necessary tax forms. If you sold crypto or received rewards of $600 or more in the tax year, you will receive a form 1099 from robinhood for this tax season.

Source: www.youtube.com

Source: www.youtube.com

How To Find Your Robinhood Tax Documents YouTube, If you’ve engaged in the trade of. But as dehaan points out, what makes this “essentially.

Source: trufinancials.com

Source: trufinancials.com

Robinhood Tax Forms TruFinancials, Credit card products are offered by. 1990968), a licensed money transmitter.

Source: www.youtube.com

Source: www.youtube.com

how to get TAX FORM from Robinhood (tax document) YouTube, You can get a form 8949 and schedule d from www.irs.gov. Credit card products are offered by.

Source: www.zenledger.io

Source: www.zenledger.io

Robinhood Tax Documents & Tax Reporting Explained ZenLedger, Since it’s a financial services company, expect to receive the following tax forms from robinhood. We’ll email you when your tax documents are ready for download by the due date.

Source: cryptotax.com

Source: cryptotax.com

Robinhood Taxes Tax Forms, By the sec and finra. Keep in mind, you won’t get a tax form if your account activity doesn’t.

The New Version Will Include Corrected In The Title With A More Recent.

You can access the tax form under.

You Can Get A Form 8949 And Schedule D From Www.irs.gov.

Robinhood securities, llc is regulated in the u.s.